Latest Blog Posts

August 15, 2019

August 15, 2019

August 15, 2019

Follow us on Facebook

Certification

CA Private Investigator

License No. 28286

PI Services

Locations Served

Client Intake Forms

Insurance Fraud Investigator

Insurance Fraud Investigator: Professional Fraud Investigation Services

Blue Systems International - Licensed Insurance Fraud Specialists

Orange County, Los Angeles, Riverside & San Bernardino County

When you need a professional insurance fraud investigator , Blue Systems International provides comprehensive fraud investigation services with over 30 years of specialized expertise. Our licensed insurance fraud investigation team serves insurance companies, employers, and legal professionals throughout Orange County, Los Angeles, Riverside, and San Bernardino County.

Insurance fraud costs billions annually and requires professional investigators who understand complex fraud schemes, legal requirements, and evidence collection standards. Our experienced insurance fraud investigator team combines traditional investigative methods with advanced surveillance technology to detect, document, and prosecute fraudulent claims effectively.

BSIS License #28286

Over 30 Years Fraud Investigation Experience

Specialized Insurance Fraud Training

Available 24/7

Professional Insurance Fraud Investigation Services

Workers Compensation Fraud Investigation

Workers compensation fraud represents one of the most common and costly types of insurance fraud. Our workers comp fraud investigator team specializes in documenting fraudulent claims through comprehensive surveillance, medical record analysis, and activity monitoring that provides court-admissible evidence.

Professional workers compensation investigations help employers and insurance companies identify fraudulent claims while protecting legitimate injured workers. Our workers compensation investigation services include surveillance of claimant activities, medical surveillance, and lifestyle analysis that reveals inconsistencies between claimed disabilities and actual capabilities.

Auto Insurance Fraud Investigation

Auto insurance fraud includes staged accidents, exaggerated injuries, and false theft claims that cost insurance companies millions annually. Our insurance fraud investigator services specialize in auto fraud detection through accident reconstruction, witness interviews, and surveillance operations.

Vehicle fraud investigations require specialized knowledge of automotive systems, accident dynamics, and insurance claim procedures. Our investigators work with accident reconstruction specialists and medical professionals to identify fraudulent claims and gather evidence supporting insurance company decisions.

Disability Insurance Fraud Investigation

Disability insurance fraud involves false or exaggerated disability claims that require comprehensive investigation to verify claim legitimacy. Our insurance fraud investigation services include medical surveillance, activity monitoring, and lifestyle analysis that documents actual functional capabilities.

Disability fraud investigations help insurance companies make informed decisions about claim validity while ensuring legitimate claimants receive appropriate benefits. Our investigators understand medical terminology, disability evaluation procedures, and legal requirements for disability claim verification.

Need Insurance Fraud Investigation Services?

Call Blue Systems International for professional insurance fraud investigator services

Call 714-592-8000 Email ConfidentiallyTypes of Insurance Fraud We Investigate

Workers Compensation Fraud

Comprehensive surveillance and documentation of workers compensation claimants to verify injury legitimacy and functional capabilities. Our investigations help employers control costs and prevent fraudulent claims.

Auto Insurance Fraud

Investigation of staged accidents, false injury claims, and vehicle theft fraud. Our auto accident investigation services include accident reconstruction and witness verification.

Health Insurance Fraud

Documentation of false medical claims, provider fraud, and patient fraud schemes. Our investigators work with healthcare organizations to identify fraudulent billing and treatment claims.

Property Insurance Fraud

Investigation of false property damage claims, arson for profit, and staged theft claims. Our asset investigation services help verify property values and ownership.

Common Insurance Fraud Indicators:

- Inconsistent injury claims and observed activities

- Delayed reporting of accidents or injuries

- Unusual accident circumstances or patterns

- Exaggerated injury descriptions or symptoms

- Refusal to provide medical records or documentation

- History of multiple insurance claims

- Suspicious witness testimony or evidence

- Working while claiming total disability

Insurance Fraud Investigation Process

Initial Case Assessment and Planning

Professional insurance fraud investigation begins with comprehensive case assessment including claim review, medical record analysis, and preliminary investigation planning. Our insurance fraud investigator team evaluates case merits and develops customized investigation strategies.

Case assessment includes reviewing insurance claim documentation, medical reports, employment records, and previous claim history. Our investigators identify red flags and develop targeted investigation approaches that maximize evidence collection while minimizing costs and timeframes.

Surveillance and Evidence Collection

Professional surveillance forms the foundation of effective insurance fraud investigation. Our investigators utilize advanced surveillance equipment and proven techniques to document claimant activities while maintaining legal compliance and evidence admissibility.

Surveillance operations include physical surveillance, video documentation, photography, and activity logging that provides comprehensive evidence of claimant capabilities. Our professional surveillance techniques ensure discreet monitoring while gathering compelling evidence for claim evaluation.

Medical and Employment Verification

Medical verification ensures claimed injuries align with actual medical conditions and functional limitations. Our insurance fraud investigator services include medical record review, doctor consultations, and independent medical examinations when appropriate.

Employment verification helps identify claimants working while claiming disability or injury. Our investigators conduct employment checks, income verification, and business ownership research that reveals undisclosed employment or income sources.

Comprehensive Reporting and Documentation

Professional insurance fraud investigation concludes with detailed reporting that documents findings, evidence, and recommendations for claim handling. Our reports meet legal standards for court proceedings and insurance company decision-making.

Investigation reports include surveillance summaries, photographic evidence, video documentation, medical analysis, and expert opinions that support claim decisions. Our comprehensive reporting ensures insurance companies have complete information for claim resolution.

Professional Fraud Investigation Training

Blue Systems International maintains specialized fraud investigation training through organizations like the Association of Certified Fraud Examiners and participates in ongoing education programs that enhance our fraud detection capabilities.

Specialized Insurance Fraud Investigation Services

Medical Surveillance and Documentation

Medical surveillance involves monitoring claimants during medical appointments, therapy sessions, and daily activities to verify claimed limitations and treatment compliance. Our insurance fraud investigator team specializes in medical surveillance that documents actual functional capabilities.

Medical surveillance helps identify inconsistencies between claimed disabilities and observed activities. Our investigators understand medical terminology, treatment procedures, and disability evaluation criteria that support accurate claim assessment.

Background Investigation and Asset Search

Comprehensive background investigations help identify claimant history, financial status, and potential motivation for fraudulent claims. Our insurance fraud investigation services include asset searches, employment history verification, and criminal background checks.

Background investigations often reveal previous insurance claims, workers compensation history, and lifestyle factors that affect claim evaluation. Our background investigation services provide complete claimant profiles for informed decision-making.

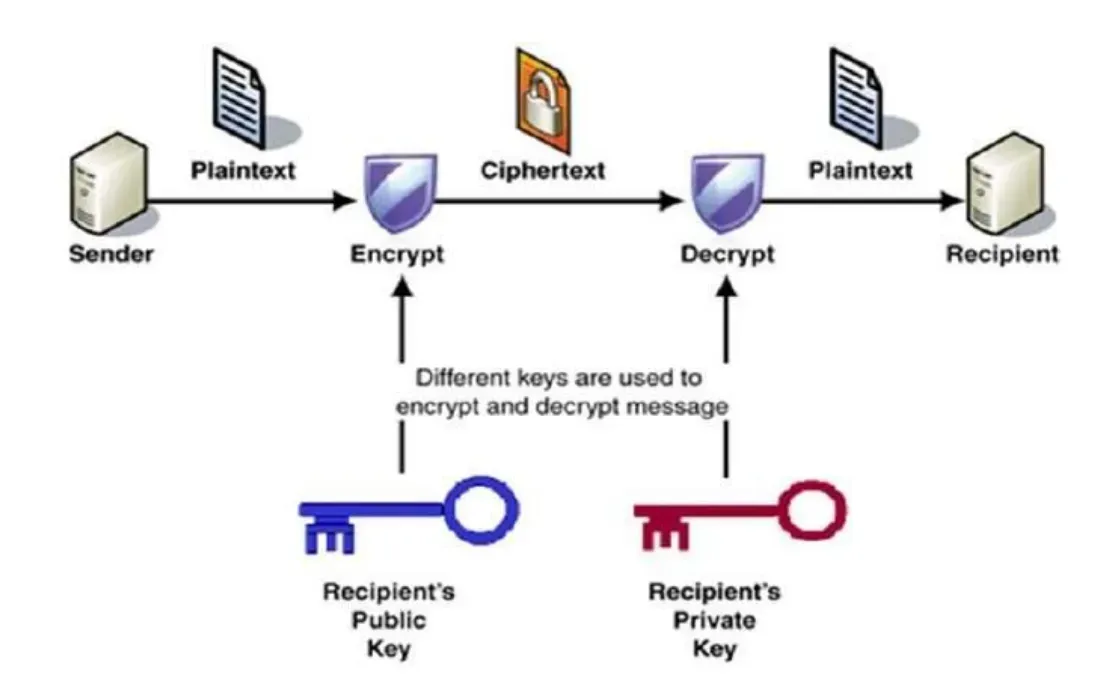

Digital Investigation and Social Media Analysis

Social media investigations reveal claimant activities, lifestyle, and capabilities that may contradict claimed disabilities or injuries. Our insurance fraud investigator services include comprehensive social media monitoring and digital evidence collection.

Digital investigations help identify fraudulent claims through social media posts, online activities, and digital communications that document actual capabilities. Our cybersecurity investigation services provide comprehensive digital evidence analysis.

Legal Compliance and Evidence Standards

California Insurance Fraud Laws

Insurance fraud investigation must comply with California insurance laws, privacy regulations, and evidence collection requirements established by the California Department of Insurance. Our investigators understand legal requirements and maintain evidence admissibility standards.

California insurance fraud laws provide specific penalties for fraudulent claims and establish procedures for investigation and prosecution. Our insurance fraud investigator services operate within legal boundaries while maximizing investigation effectiveness.

Privacy Laws and Investigation Boundaries

Professional insurance fraud investigation respects privacy rights while gathering evidence within legal boundaries. Our investigators understand surveillance limitations, privacy protections, and legal requirements that govern investigation activities.

Investigation boundaries ensure evidence admissibility while protecting both insurance companies and claimants from liability. Blue Systems International maintains strict compliance with privacy laws and professional ethical standards.

Evidence Collection and Chain of Custody

Professional evidence collection requires strict procedures that ensure court admissibility and legal protection. Our insurance fraud investigator team maintains detailed chain of custody documentation and evidence preservation standards.

Evidence standards include photographic documentation, video evidence, witness statements, and expert analysis that meets judicial requirements for insurance fraud prosecution and claim denial proceedings.

Technology and Advanced Investigation Methods

Advanced Surveillance Equipment

Modern insurance fraud investigation utilizes advanced surveillance equipment including high-definition cameras, GPS tracking systems, and digital monitoring tools that provide superior evidence quality and documentation capabilities.

Professional surveillance equipment ensures clear documentation of claimant activities while maintaining investigator safety and case discretion. Our investigators utilize the latest technology while respecting privacy rights and legal boundaries.

Database Research and Intelligence Gathering

Professional insurance fraud investigator services access specialized databases and research tools that provide comprehensive background information and claim verification capabilities. Database access enables thorough investigations and accurate claim assessment.

Research capabilities include property records, employment verification, medical provider databases, and court records that support comprehensive fraud investigation and claim evaluation.

Video Analysis and Documentation

Video evidence provides compelling documentation of claimant activities and capabilities that support insurance company decisions. Our insurance fraud investigation services include professional video analysis and expert testimony when required.

Video documentation must meet legal standards for court admissibility and insurance company use. Our investigators understand video evidence requirements and provide professional analysis that supports claim decisions.

Ready for Professional Fraud Investigation?

Contact Blue Systems International for expert insurance fraud investigator services

Call 714-592-8000 Visit Our WebsiteIndustry Expertise and Client Services

Insurance Company Support

Our insurance fraud investigator services support insurance companies with comprehensive fraud detection, claim verification, and evidence collection that enables informed claim decisions. We understand insurance company needs and provide cost-effective investigation solutions.

Insurance company services include claim evaluation, fraud detection training, case consultation, and expert testimony that supports claim denial and fraud prosecution efforts. Our experience includes major insurance carriers and self-insured organizations.

Employer and Self-Insured Services

Self-insured employers benefit from insurance fraud investigation services that help control workers compensation costs and prevent fraudulent claims. Our investigators understand employer concerns and provide practical fraud prevention strategies.

Employer services include workers compensation fraud investigation, return-to-work monitoring, and prevention training that helps organizations protect against fraudulent claims while supporting legitimate injured workers.

Legal Professional Support

Attorneys and legal professionals utilize our insurance fraud investigator services for litigation support, evidence collection, and expert testimony in insurance fraud cases. Our investigators understand legal requirements and provide professional courtroom testimony.

Legal support services include case consultation, evidence analysis, witness preparation, and expert testimony that supports insurance fraud prosecution and claim defense strategies.

Geographic Coverage and Local Expertise

Orange County Insurance Fraud Investigation

Orange County insurance companies and employers receive expert insurance fraud investigation services from investigators who understand local medical providers, rehabilitation facilities, and employment markets that affect claim evaluation.

Orange County coverage includes Santa Ana, Anaheim, Irvine, Newport Beach, Huntington Beach, and surrounding communities. Our local expertise ensures effective fraud investigation throughout the county.

Los Angeles County Coverage

Los Angeles County clients benefit from comprehensive insurance fraud investigator services that address the complexity and diversity of the region's healthcare system, employment markets, and claim patterns.

Los Angeles coverage includes Downtown Los Angeles, Hollywood, Santa Monica, Beverly Hills, Burbank, Glendale, and surrounding areas. Our established presence provides immediate response and local knowledge for effective investigations.

Riverside and San Bernardino Counties

Our insurance fraud investigation services extend throughout Riverside and San Bernardino Counties with investigators who understand rural and suburban claim patterns, medical providers, and employment opportunities.

Regional coverage includes Riverside, Moreno Valley, Palm Springs, San Bernardino, Fontana, Rancho Cucamonga, and surrounding communities throughout both counties.

Cost-Effective Fraud Investigation Solutions

Return on Investment Analysis

Professional insurance fraud investigation provides significant return on investment through claim savings, fraud prevention, and reduced administrative costs. Our investigations often save multiples of investigation costs through accurate claim evaluation.

Cost-benefit analysis helps insurance companies evaluate investigation value and make informed decisions about claim handling. Our insurance fraud investigator services provide transparent pricing and measurable results.

Efficient Investigation Methods

Efficient investigation methods minimize costs while maximizing evidence quality and claim resolution speed. Our insurance fraud investigation services utilize proven techniques that deliver results within reasonable timeframes and budgets.

Investigation efficiency includes targeted surveillance, comprehensive planning, and advanced technology that reduces investigation time while maintaining evidence quality and legal compliance.

Fraud Prevention Training and Consultation

Fraud prevention training helps insurance companies and employers identify fraud indicators early and implement effective prevention strategies. Our insurance fraud investigator services include training programs and consultation that reduce overall fraud exposure.

Prevention strategies often provide greater value than reactive investigation by identifying and stopping fraudulent claims before significant costs accumulate. Our training programs help organizations develop internal fraud detection capabilities.

Getting Started with Insurance Fraud Investigation

Free Consultation and Case Assessment

Our insurance fraud investigation services begin with free consultation and case assessment that evaluates claim merits and investigation potential. Initial consultation helps determine appropriate investigation approaches and expected outcomes.

Case assessment includes claim review, fraud indicator identification, and investigation planning that ensures efficient resource utilization and optimal results. Our experienced team provides honest evaluation and realistic expectations.

Investigation Planning and Authorization

Professional investigation planning ensures insurance fraud investigator services focus on relevant evidence collection and claim resolution objectives. Detailed planning includes timeline development, resource allocation, and milestone identification.

Investigation authorization includes clear scope definition, budget parameters, and communication protocols that ensure effective collaboration between investigators and insurance company personnel throughout the investigation process.

Ongoing Communication and Reporting

Regular communication ensures insurance companies remain informed about insurance fraud investigation progress and can make timely decisions about claim handling. Our investigators provide scheduled updates and immediate notification of significant developments.

Communication protocols include secure reporting systems, emergency contact procedures, and confidentiality protection that ensures sensitive information remains secure throughout the investigation process.

Contact Blue Systems International

When you need professional insurance fraud investigator services, Blue Systems International provides comprehensive fraud investigation solutions with over 30 years of specialized expertise. Our team understands insurance industry needs and provides cost-effective investigation services that deliver measurable results.

Whether you need workers compensation fraud investigation, auto insurance fraud detection, or comprehensive claim verification, our insurance fraud investigation services provide the expertise and evidence quality necessary for informed claim decisions and fraud prosecution.

Contact Blue Systems International at 714-592-8000 to discuss your insurance fraud investigator needs with experienced professionals who understand the importance of thorough investigation, legal compliance, and cost-effective fraud detection. Our free consultation helps you understand your options and develop effective fraud investigation strategies for your specific requirements.